The coronavirus (Covid-19) has had a massive impact on the economy. Between the stock market crashing over 30% within a month, to the massive amounts of stimulus by governments, followed by a massive gain of over 80% during the past year. Some sectors, such as the airline/travel sector, were hit the hardest, while others, such as the Technology sector, soared to all-time highs.

In this blog post, we are going to look at how the coronavirus affected each individual sector stock prices, how they recovered, and where they go from here. This will hopefully help you in your research by giving you insight into which sector provides good growth opportunities, and which ones may be in trouble.

Let’s start with a graph showing a comparison of all sectors.

Technology Sector

When the coronavirus forced countries to go into lockdowns, companies had to adapt in order to survive. Companies faced all sorts of new problems, such as store fronts closing, being unable to fly for meetings, unable to reach their customers, ect. For the companies that had solutions to these problems, business started to boom.

Zoom Video Communications (ticker ZM) offered an alternative to in-person meetings. You were able to have meetings from anywhere in the world. Their stock went from $67 in January 2020 to a staggering $559 by October 2020 (a 734% increase)!

Amazon was another huge company that benefited. Closures meant people were forced to shop online now, and Amazon is the largest online retailer. Their stock price went from about $1900 in January 2020 to over $3250!

Here is a chart showing the overall sector. We are using the XLK ETF for this analysis. Just before the crash, it was at $101.72. With a drop of 31% it priced in at $70.04, and it is currently at $138.64. That is a 98% increase from its low or a 36% increase from pre-covid levels.

Airline Sector

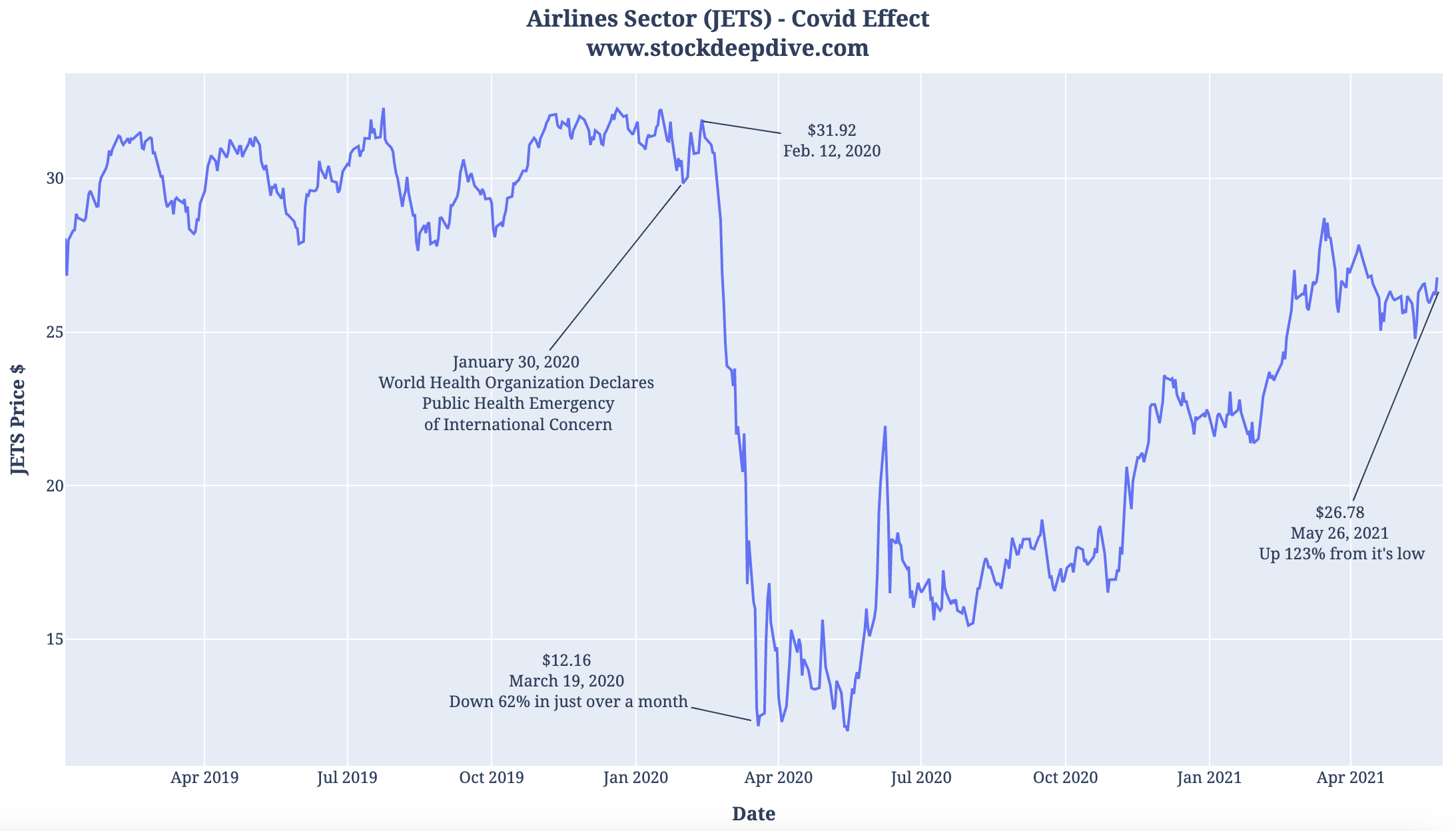

On the other end of the spectrum, we have the airline sector. Airlines were probably the sector hit the hardest by covid, along with other travel/vacation. With passengers almost dropping to zero, they saw their revenue plummet. Some airlines went bankrupt, and the ones that didn’t took on large amounts of debt to (hopefully) hold them through. In most countries, travel still hasn’t recovered to levels it was before the pandemic, though the large number of people getting vaccinated has helped a lot.

It will likely be a while before airlines get back to where they were, but for long term investors it may provide an opportunity for certain airlines that are poised for growth once the recovery is further under way. One thing you have to watch out for is the amount of debt they have taken on, and how those new interest payments will affect their future cash flows.

Here is a chart showing the airline sector, which we used the JETS ETF to analyze. It dropped 62% in just over a month at the start of the pandemic. It’s currently up 123% from its low. Still not fully recovered, down about 16% from its pre-covid value.

It will be interesting to see how many companies go back to having meetings in person compared to how many stick with their new solutions such as using Zoom, and how this affects the travel industry.

Financial Sector

The financial sector took a hard hit, like every sector, at the start of the pandemic but has had a nice recovery since. Due to the number of customers and businesses not being able to pay their loans, many large banks added a large amount of loan loss provisions in the first quarter of 2020. Recently profit has surged, as bad loans were not as severe as originally anticipated.

Here is the chart for the financial sector. For the financial sector we are using the XLF ETF. It dropped from $31.07 on February 20th, 2020 to $17.66 on March 23, 2020 (a 43% drop). Since then it is up 112% from its low, or 20% from its pre-covid levels, to $37.49.

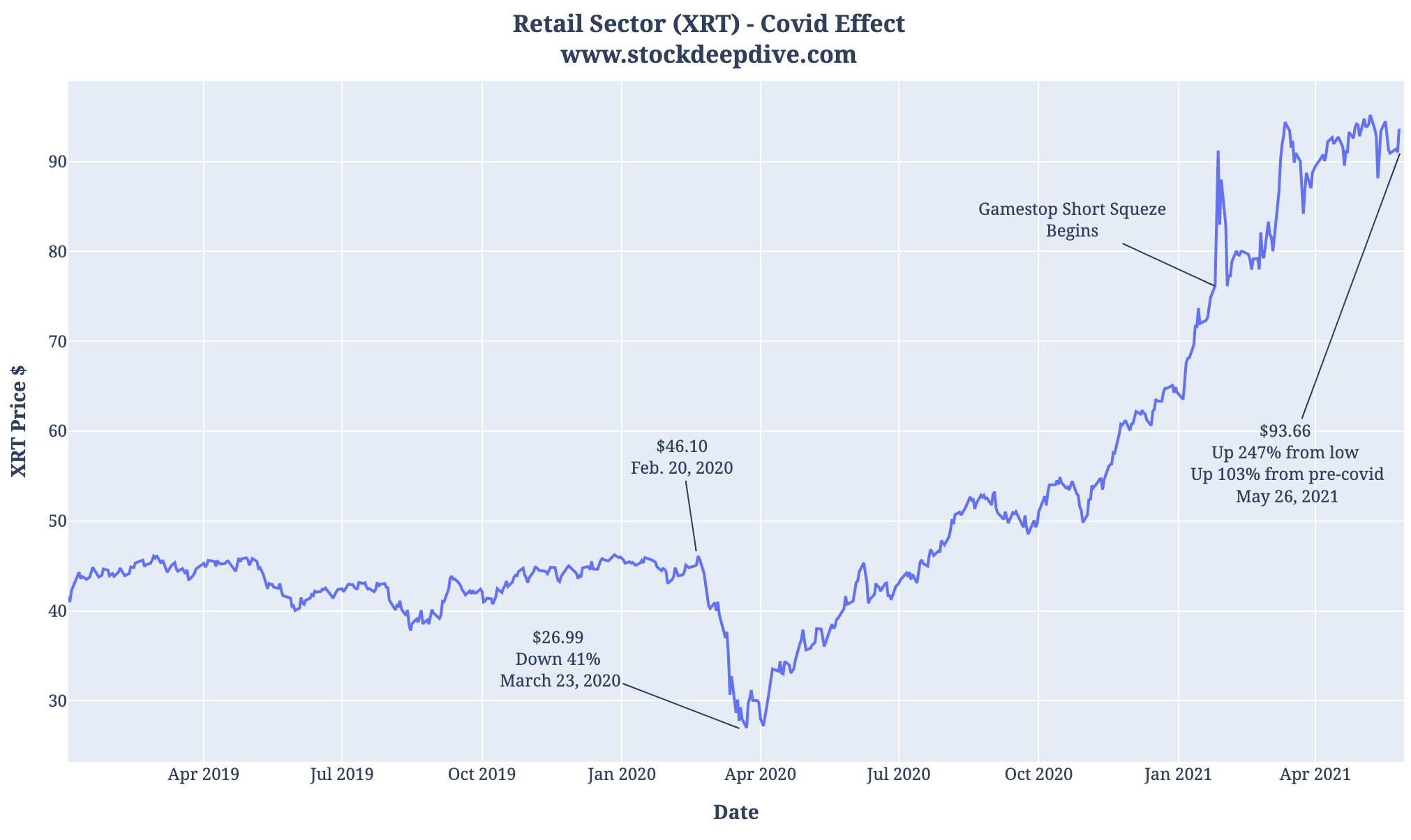

Retail Sector

This was probably the biggest surprise to me while making this blog post. After a further look at a lot of the top holdings of this ETF, it appears a lot of the companies were able to pivot to online sales which helped propel them. It also didn’t hurt that GameStop was involved in a massive short squeeze!

Here is a look at the retail sector chart We used the XRT ETF for this analysis. It dropped from $46.10 on Feb 20, 2020 to $26.99 on March 23, 2020 (a 41% drop). It then recovered to all-time highs. As of May 26th, 2021 it was priced at $93.66, which is up a staggering 247% from the March 2020 lows. This is up 103% from pre-covid levels.

Do you think consumers will start shopping in stores again as more businesses continue to open?

Other Sectors

Here we will go over some of the other sector’s numbers quickly without the graphs, as they are all fairly similar.

We will start with the Healthcare sector, for which we used the XLV ETF. Between February 21, 2020 and March 23rd, 2020 it dropped from $103.41 to $74.62 (28% decrease). It then recovered fairly well, increasing to $123.39 as of May 26, 2021, which represents a 65% increase from March lows or a 19% increase from pre-covid levels.

Next up is the Real Estate sector with the ETF IYR. At close on February 21, 2020, it was priced at 100.21. It dropped to a low of $57.84 on March 23, 2020. This is a drop of 42%. It has since recovered to $99.84 on May 26, 2021, which is a 72% increase from March lows or a slight decrease from pre-covid levels.

Conclusion

Covid-19 clearly had a large impact on all sectors, in particular at the start when there was so much uncertainty. As time passed, with government stimulus and companies adapting, most sectors have recovered with some reaching all-time highs. Some sectors came out stronger, such as the technology and retail sectors. Others barely survived, such as the travel sector.

Going forward, companies will have to continue to adapt. There are still a lot of unknowns with Covid-19, such as if we will reach the vaccination threshold needed for herd immunity, or If the vaccine will require annual boosters. There are still opportunities in certain sectors, you just need to dig a little deeper to find them!

Are you looking at any particular sector currently? Did any sector surprise you? Do you think any sector is currently undervalued? Let us know in the comments!

640 comments

canadian pharmacy - Dec. 6, 2023, 1:22 a.m.

- Wow that was odd. I just wrote an extremely long comment but after I clicked submit my comment didn't appear. Grrrr... well I'm not writing all that over again. Anyhow, just wanted to say great blog!

online canadian pharmacy - Dec. 6, 2023, 2:17 a.m.

- cheap prescription drugs <a href=https://canadianpharmacy.maweb.eu/#>cialis pharmacy online </a> cheap pharmacy online <a href="https://canadianpharmacy.maweb.eu/#">canada pharmacies </a> canadian drugs online pharmacies https://canadianpharmacy.maweb.eu/

Brekety-stom.ru_mqkn - Dec. 6, 2023, 2:35 a.m.

- Преимущества и недостатки исправление прикуса <a href=https://brekety-stom.ru>https://brekety-stom.ru</a>.

Brekety-stom.ru_vskn - Dec. 6, 2023, 4:11 a.m.

- Ориентировочные цены на установку damon Q <a href=https://www.brekety-stom.ru/>https://www.brekety-stom.ru/</a>.

canadian online pharmacy - Dec. 6, 2023, 5:11 a.m.

- apollo pharmacy online <a href=https://canadianpharmacy.maweb.eu/#>online order medicine </a> pharmacy cheap no prescription <a href="https://canadianpharmacy.maweb.eu/#">order medicine online </a> online pharmacies https://canadianpharmacy.maweb.eu/

Brekety-stom.ru_hfkn - Dec. 6, 2023, 5:32 a.m.

- Брекеты за один день Брекет-система <a href=https://brekety-stom.ru/>https://brekety-stom.ru/</a>.

Brekety-stom.ru_gdkn - Dec. 6, 2023, 6:58 a.m.

- Плюсы и минусы прозрачных систем Damon <a href=https://www.brekety-stom.ru/>https://www.brekety-stom.ru/</a>.

online pharmacies canada - Dec. 6, 2023, 8:06 a.m.

- best online international pharmacies <a href=https://canadianpharmacy.maweb.eu/#>discount pharmacy </a> online pharmacy canada <a href="https://canadianpharmacy.maweb.eu/#">canadian drugs </a> canada online pharmacies https://canadianpharmacy.maweb.eu/

Brekety-stom.ru_uykn - Dec. 6, 2023, 8:39 a.m.

- Вредны ли брекеты для здоровья? исправление прикуса <a href=https://brekety-stom.ru>https://brekety-stom.ru</a>.

Brekety-stom.ru_gnkn - Dec. 6, 2023, 10:37 a.m.

- Брекеты для взрослых damon Q <a href=https://www.brekety-stom.ru/>https://www.brekety-stom.ru/</a>.

canada online pharmacy - Dec. 6, 2023, 10:57 a.m.

- canadian cialis <a href=https://canadianpharmacy.maweb.eu/#>canadian pharmacy online </a> walmart pharmacy online <a href="https://canadianpharmacy.maweb.eu/#">shoppers drug mart canada </a> canada pharmaceuticals online generic https://canadianpharmacy.maweb.eu/

canada pharmaceuticals online - Dec. 6, 2023, 11:20 a.m.

- Informative article, exactly what I was looking for.

Brekety-stom.ru_askn - Dec. 6, 2023, 12:36 p.m.

- Особенности установки прозрачных брекетов Когда нужна ретенционная капа <a href=brekety-stom.ru>brekety-stom.ru</a>.

on line pharmacy - Dec. 6, 2023, 1:46 p.m.

- pharmacy online <a href=https://canadianpharmacy.maweb.eu/#>online medicine shopping </a> online pharmacy canada <a href="https://canadianpharmacy.maweb.eu/#">drugstore online </a> viagra generic online pharmacy https://canadianpharmacy.maweb.eu/

Brekety-stom.ru_jikn - Dec. 6, 2023, 2:43 p.m.

- Сколько стоят брекеты? damon Q <a href=brekety-stom.ru>brekety-stom.ru</a>.

pharmacy online - Dec. 6, 2023, 4:19 p.m.

- It's going to be ending of mine day, except before end I am reading this great paragraph to increase my experience.

Brekety-stom.ru_njkn - Dec. 6, 2023, 5:07 p.m.

- Советы для облегченного выбора исправление прикуса <a href=https://brekety-stom.ru>https://brekety-stom.ru</a>.

Brekety-stom.ru_hikn - Dec. 6, 2023, 8:12 p.m.

- Как почистить брекеты? damon Q <a href=http://brekety-stom.ru/>http://brekety-stom.ru/</a>.

online pharmacies in usa - Dec. 6, 2023, 8:17 p.m.

- canadian pharmacy viagra generic <a href=https://canadianpharmacy.maweb.eu/#>pharmacy </a> canadian pharmacy online <a href="https://canadianpharmacy.maweb.eu/#">discount pharmacy </a> canadian drugs pharmacy https://canadianpharmacy.maweb.eu/

mtalethwhe - Dec. 6, 2023, 8:46 p.m.

- home made viagra recipe viagra online kaufen per nachnahme <a href="https://pharmicasssale.com/">best viagra alternative</a> where can you get viagra viagra pills

canadian pharmacies online - Dec. 6, 2023, 9:58 p.m.

- Great items from you, man. I have take into accout your stuff prior to and you are just extremely magnificent. I actually like what you have bought here, really like what you are saying and the way in which you are saying it. You make it entertaining and you still care for to stay it sensible. I can't wait to learn far more from you. That is really a terrific site.

Brekety-stom.ru_wokn - Dec. 6, 2023, 10:19 p.m.

- Как поддерживать результат лечения после снятия брекетов? дистопированные единицы <a href=https://www.brekety-stom.ru/>https://www.brekety-stom.ru/</a>.

canada online pharmacies - Dec. 7, 2023, 12:22 a.m.

- Do you have any video of that? I'd like to find out more details.

Brekety-stom.ru_cakn - Dec. 7, 2023, 12:26 a.m.

- Способы ускорить процесс лечения с брекетами Брекет-система <a href=http://www.brekety-stom.ru>http://www.brekety-stom.ru</a>.

pharmacies shipping to usa - Dec. 7, 2023, 1:57 a.m.

- canadian pharmacy generic viagra <a href=https://canadianpharmacy.maweb.eu/#>canadian pharmacy cialis 20mg </a> medical pharmacies <a href="https://canadianpharmacy.maweb.eu/#">canada pharmacies </a> pharmacy online cheap https://canadianpharmacy.maweb.eu/

Brekety-stom.ru_bskn - Dec. 7, 2023, 2:37 a.m.

- Советы родителям при выборе системы для детей Установка Дамон Клир <a href=http://brekety-stom.ru/>http://brekety-stom.ru/</a>.

canada online pharmacy - Dec. 7, 2023, 2:43 a.m.

- I am extremely inspired together with your writing talents and also with the structure for your weblog. Is that this a paid theme or did you customize it yourself? Anyway keep up the excellent high quality writing, it's uncommon to peer a nice blog like this one today..

Brekety-stom.ru_mukn - Dec. 7, 2023, 5 a.m.

- Основы установки брекетов Damon <a href=https://brekety-stom.ru/>https://brekety-stom.ru/</a>.

Brekety-stom.ru_szkn - Dec. 7, 2023, 6:58 a.m.

- Советы для облегченного выбора Установка Дамон Клир <a href=https://www.brekety-stom.ru>https://www.brekety-stom.ru</a>.

online canadian pharmacies - Dec. 7, 2023, 7:38 a.m.

- generic viagra online pharmacy <a href=https://canadianpharmacy.maweb.eu/#>prescription drugs from canada </a> canadian online pharmacies <a href="https://canadianpharmacy.maweb.eu/#">online order medicine </a> online pharmacies of canada https://canadianpharmacy.maweb.eu/

Brekety-stom.ru_tgkn - Dec. 7, 2023, 9:06 a.m.

- Положительные результаты лечения в детском возрасте Невидимые брекеты Инкогнито <a href=http://brekety-stom.ru/>http://brekety-stom.ru/</a>.

international pharmacy - Dec. 7, 2023, 9:55 a.m.

- This is the perfect website for anybody who hopes to understand this topic. You realize so much its almost tough to argue with you (not that I really would want to…HaHa). You definitely put a brand new spin on a topic that's been written about for years. Great stuff, just excellent!

online canadian pharmacy - Dec. 7, 2023, 10:25 a.m.

- canadian online pharmacies <a href=https://canadianpharmacy.maweb.eu/#>canada pharmacies </a> online drugstore <a href="https://canadianpharmacy.maweb.eu/#">canadian cialis </a> discount pharmacy https://canadianpharmacy.maweb.eu/

Brekety-stom.ru_yzkn - Dec. 7, 2023, 11:06 a.m.

- Преимущества и недостатки ретинированные зубы <a href=http://www.brekety-stom.ru/>http://www.brekety-stom.ru/</a>.

qtaletuerk - Dec. 7, 2023, 11:38 a.m.

- men and women essay the civil war essay <a href="https://essayservicewrday.com/">how to write a conclusion paragraph for an essay</a> essay on my school in french language essay on anger management

Brekety-stom.ru_mgkn - Dec. 7, 2023, 1:11 p.m.

- Брекеты за один день Damon <a href=http://brekety-stom.ru/>http://brekety-stom.ru/</a>.

Brekety-stom.ru_lxkn - Dec. 7, 2023, 3:18 p.m.

- Плюсы и минусы прозрачных систем Брекеты Дэймон <a href=https://www.brekety-stom.ru>https://www.brekety-stom.ru</a>.

Brekety-stom.ru_orkn - Dec. 7, 2023, 5:30 p.m.

- Ортодонтическая хирургия Когда нужна ретенционная капа <a href=https://www.brekety-stom.ru>https://www.brekety-stom.ru</a>.

canadian pharmacy - Dec. 7, 2023, 7:02 p.m.

- pharmacies online <a href=https://canadianpharmacy.maweb.eu/#>pharmacies online </a> navarro pharmacy miami <a href="https://canadianpharmacy.maweb.eu/#">prescription drugs from canada </a> pharmacy online shopping https://canadianpharmacy.maweb.eu/

Brekety-stom.ru_rmkn - Dec. 7, 2023, 7:33 p.m.

- Сроки и результаты лечения damon Q <a href=https://brekety-stom.ru/>https://brekety-stom.ru/</a>.

Brekety-stom.ru_wckn - Dec. 7, 2023, 9:40 p.m.

- Диета и правила питания для пациентов ретинированные зубы <a href=brekety-stom.ru>brekety-stom.ru</a>.

canadian online pharmacy - Dec. 7, 2023, 10:32 p.m.

- I do not even know how I ended up here, but I believed this put up was once great. I do not understand who you're however definitely you are going to a famous blogger if you happen to aren't already. Cheers!

Brekety-stom.ru_unkn - Dec. 7, 2023, 11:36 p.m.

- Сколько стоят брекеты? ретейнеры <a href=https://www.brekety-stom.ru>https://www.brekety-stom.ru</a>.

online pharmacies in usa - Dec. 8, 2023, 12:50 a.m.

- What's up to all, for the reason that I am truly keen of reading this weblog's post to be updated on a regular basis. It carries pleasant data.

Brekety-stom.ru_qmkn - Dec. 8, 2023, 1:37 a.m.

- Способы ускорить процесс лечения с брекетами Керамические и сапфировые малозаметные брекеты <a href=https://www.brekety-stom.ru/>https://www.brekety-stom.ru/</a>.

Brekety-stom.ru_gekn - Dec. 8, 2023, 3:37 a.m.

- Как питаться с брекетами? дистопированные единицы <a href=http://brekety-stom.ru/>http://brekety-stom.ru/</a>.

canada pharmacy - Dec. 8, 2023, 5:36 a.m.

- Your style is unique compared to other folks I have read stuff from. Many thanks for posting when you've got the opportunity, Guess I'll just book mark this page.

canadian drugs - Dec. 8, 2023, 9:05 a.m.

- discount pharmacies <a href=https://canadianpharmacy.maweb.eu/#>canadian drugs online pharmacy </a> best canadian online pharmacies <a href="https://canadianpharmacy.maweb.eu/#">canadian pharmacy </a> shoppers drug mart canada https://canadianpharmacy.maweb.eu/

online pharmacies canada - Dec. 8, 2023, 10:26 a.m.

- What's up, everything is going nicely here and ofcourse every one is sharing information, that's actually fine, keep up writing.

prescriptions online - Dec. 8, 2023, 12:49 p.m.

- Hi there colleagues, pleasant piece of writing and good urging commented here, I am actually enjoying by these.

canadian drugs - Dec. 8, 2023, 2:42 p.m.

- pharmacy drugstore online <a href=https://canadianpharmacy.maweb.eu/#>online drugstore pharmacy </a> online pharmacies legitimate <a href="https://canadianpharmacy.maweb.eu/#">canadian pharmacy online </a> canadian pharmacies-24h https://canadianpharmacy.maweb.eu/

canada pharmacies - Dec. 8, 2023, 11:44 p.m.

- I am really loving the theme/design of your site. Do you ever run into any web browser compatibility issues? A handful of my blog visitors have complained about my blog not working correctly in Explorer but looks great in Safari. Do you have any solutions to help fix this issue?

canadian pharmacies online - Dec. 9, 2023, 3:57 a.m.

- I am actually thankful to the owner of this website who has shared this impressive paragraph at here.

canadian pharcharmy - Dec. 9, 2023, 6:12 a.m.

- I am not sure where you are getting your information, but great topic. I needs to spend some time learning much more or understanding more. Thanks for great info I was looking for this information for my mission.

pharmacie - Dec. 9, 2023, 8:28 a.m.

- Useful information. Lucky me I found your site unintentionally, and I'm surprised why this accident didn't took place in advance! I bookmarked it.

canadian pharmacies shipping to usa - Dec. 9, 2023, 6:10 p.m.

- An outstanding share! I've just forwarded this onto a coworker who had been conducting a little research on this. And he in fact bought me dinner simply because I stumbled upon it for him... lol. So let me reword this.... Thanks for the meal!! But yeah, thanx for spending the time to talk about this subject here on your blog.

pharmacy uk - Dec. 10, 2023, 8:56 a.m.

- Keep on working, great job!

canadian pharmacy - Dec. 10, 2023, 11:16 a.m.

- There is definately a great deal to know about this subject. I really like all the points you've made.

canadian pharmacies - Dec. 10, 2023, 1:42 p.m.

- I always used to read paragraph in news papers but now as I am a user of web so from now I am using net for articles, thanks to web.

pharmeasy - Dec. 10, 2023, 10:11 p.m.

- Nice post. I learn something totally new and challenging on blogs I stumbleupon on a daily basis. It will always be useful to read through content from other authors and practice something from their sites.

pharmacy - Dec. 11, 2023, 1:20 a.m.

- I have been surfing online more than three hours today, yet I never found any interesting article like yours. It is pretty worth enough for me. In my opinion, if all web owners and bloggers made good content as you did, the net will be much more useful than ever before.

canada online pharmacy - Dec. 11, 2023, 3:13 a.m.

- canadian pharmacy [url=https://canadianpharmacy.maweb.eu/#]canadian pharmacies online [/url] viagra generic online pharmacy <a href="https://canadianpharmacy.maweb.eu/#">drugstore online shopping </a> canadian government approved pharmacies https://canadianpharmacy.maweb.eu/

prescriptions online - Dec. 11, 2023, 4:24 a.m.

- Hello mates, how is the whole thing, and what you wish for to say concerning this piece of writing, in my view its in fact amazing in support of me.

pharmacy online - Dec. 11, 2023, 5:46 a.m.

- canadian online pharmacies [url=https://canadianpharmacy.maweb.eu/#]pharmacies shipping to usa [/url] canada pharmaceuticals online generic <a href="https://canadianpharmacy.maweb.eu/#">international pharmacy </a> national pharmacies online https://canadianpharmacy.maweb.eu/

canadian pharcharmy online - Dec. 11, 2023, 8:22 a.m.

- generic viagra online pharmacy [url=https://canadianpharmacy.maweb.eu/#]medicine online shopping [/url] international pharmacy <a href="https://canadianpharmacy.maweb.eu/#">canada pharmaceuticals online </a> pharmacy on line https://canadianpharmacy.maweb.eu/

canada pharmaceuticals online - Dec. 11, 2023, 10:54 a.m.

- aarp recommended canadian pharmacies [url=https://canadianpharmacy.maweb.eu/#]discount canadian drugs [/url] canada pharmacy <a href="https://canadianpharmacy.maweb.eu/#">online pharmacy drugstore </a> pharmacy online cheap https://canadianpharmacy.maweb.eu/

canadian pharmacy online - Dec. 11, 2023, 1:23 p.m.

- Have you ever considered writing an e-book or guest authoring on other blogs? I have a blog based upon on the same subjects you discuss and would really like to have you share some stories/information. I know my audience would enjoy your work. If you're even remotely interested, feel free to send me an e mail.

canada pharmaceuticals online - Dec. 11, 2023, 7:20 p.m.

- canada pharmacy [url=https://canadianpharmacy.maweb.eu/#]canadian online pharmacies [/url] canada online pharmacies <a href="https://canadianpharmacy.maweb.eu/#">pharmacy in canada </a> aarp recommended canadian pharmacies https://canadianpharmacy.maweb.eu/

pharmeasy - Dec. 11, 2023, 11:39 p.m.

- Hmm it looks like your site ate my first comment (it was extremely long) so I guess I'll just sum it up what I submitted and say, I'm thoroughly enjoying your blog. I too am an aspiring blog blogger but I'm still new to the whole thing. Do you have any helpful hints for novice blog writers? I'd certainly appreciate it.

pharmacies - Dec. 12, 2023, 3:40 a.m.

- shoppers pharmacy [url=https://canadianpharmacy.maweb.eu/#]national pharmacies [/url] best online canadian pharmacy <a href="https://canadianpharmacy.maweb.eu/#">international pharmacy </a> cheap prescription drugs https://canadianpharmacy.maweb.eu/

canadian pharcharmy online - Dec. 12, 2023, 8:50 a.m.

- medical pharmacy [url=https://canadianpharmacy.maweb.eu/#]pharmacy online [/url] on line pharmacy <a href="https://canadianpharmacy.maweb.eu/#">pills viagra pharmacy 100mg </a> drugstore online shopping https://canadianpharmacy.maweb.eu/

pharmacies - Dec. 12, 2023, 11:22 a.m.

- prescription drugs from canada [url=https://canadianpharmacy.maweb.eu/#]canada pharmacy [/url] navarro pharmacy <a href="https://canadianpharmacy.maweb.eu/#">medicine online shopping </a> canada online pharmacies https://canadianpharmacy.maweb.eu/

canada pharmacies - Dec. 12, 2023, 11:43 a.m.

- Greetings from California! I'm bored at work so I decided to check out your site on my iphone during lunch break. I really like the info you present here and can't wait to take a look when I get home. I'm amazed at how quick your blog loaded on my phone .. I'm not even using WIFI, just 3G .. Anyhow, amazing site!

online prescriptions - Dec. 12, 2023, 6:13 p.m.

- It is truly a nice and useful piece of information. I am happy that you shared this useful information with us. Please stay us up to date like this. Thank you for sharing.

international pharmacy - Dec. 12, 2023, 7:56 p.m.

- canada pharmacy [url=https://canadianpharmacy.maweb.eu/#]online medicine order discount [/url] generic viagra online <a href="https://canadianpharmacy.maweb.eu/#">canadian pharmacies-247 </a> pharmacy online https://canadianpharmacy.maweb.eu/

canadian pharmacy online - Dec. 12, 2023, 9:46 p.m.

- I like the valuable info you provide for your articles. I will bookmark your weblog and take a look at once more right here frequently. I'm somewhat certain I'll be informed a lot of new stuff right here! Good luck for the next!

IlonaviB - Dec. 12, 2023, 11:15 p.m.

- Здравствуйте! Как можно разнообразить повседневную рутину и выбраться из застоя? Какие активности могут вызвать у вас яркие эмоции? Возможно, любимое хобби, спорт, путешествия или экстремальные виды отдыха. Или вы наслаждаетесь экзотической и необычной кухней, или отличными кулинарными шедеврами для близких. Но современный ритм жизни зачастую ограничивает время и финансы для отличного времяпрепровождения. Существует ли способ перервать серию повседневных испытаний, оторваться от реальности и испытать новые впечатления? На мой взгляд, кино - лучшее решение. Кинематограф стал неотъемлемой частью нашей жизни, порой мы даже не замечаем, как фильмы становятся нашей частью. Иногда сюжет картины так захватывает, что мы теряем чувство времени и готовы смотреть до утра или пропустить важную встречу. Мы видим себя в героях и забываем о собственных проблемах, переживая их переживания. Кино - это не только развлечение, но и источник вдохновения, опыта и новых знаний. Кино доступно на различных онлайн-платформах. Однако, многие из них требуют регистрации, платежей или ограничены в определенных регионах. Но я хотел бы порекомендовать вам проект, который стал для меня открытием - https://hd-rezka.cc. Здесь минимум рекламы, а также вы можете оставить запрос на просмотр фильма, который хотели бы увидеть. Главное преимущество - отсутствие ограничений в доступе к контенту. Просто заходите и наслаждайтесь просмотром. Кстати вот интересные разделы! [url=Страна призраков смотреть онлайн бесплатно (2018) в хорошем качестве]https://hd-rezka.cc/films/12191-strana-prizrakov-2018.html[/url] [url=Рассел Малкэй Смотреть фильмы и сериалы онлайн в хорошем качестве 720p hd и без регистрации]https://hd-rezka.cc/directors/%D0%A0%D0%B0%D1%81%D1%81%D0%B5%D0%BB%20%D0%9C%D0%B0%D0%BB%D0%BA%D1%8D%D0%B9/[/url] [url=Любовь, секс пандемия смотреть онлайн бесплатно (2022) в хорошем качестве на HDREZKA]https://hd-rezka.cc/films/220-ljubov-seks-ampampamp-pandemija-2022.html[/url] [url=Безсоновъ смотреть онлайн бесплатно сериал 1 сезон 1-20 серия]https://hd-rezka.cc/series/11844-bezsonov-2023.html[/url] [url=Лучшие спортивные 2020 года]https://hd-rezka.cc/animation/sport/best/2020/[/url] ТиДжей Миллер Смотреть фильмы и сериалы онлайн в хорошем качестве 720p hd и без регистрации Мультфильмы в жанре приключения - смотреть онлайн бесплатно в хорошем качестве Эдриан Броуди Смотреть фильмы и сериалы онлайн в хорошем качестве 720p hd и без регистрации Рэйчел Келлер Смотреть фильмы и сериалы онлайн в хорошем качестве 720p hd и без регистрации Рута Гедминтас Смотреть фильмы и сериалы онлайн в хорошем качестве 720p hd и без регистрации Янина Малинчик Смотреть фильмы и сериалы онлайн в хорошем качестве 720p hd и без регистрации Дарья Рудь Смотреть фильмы и сериалы онлайн в хорошем качестве 720p hd и без регистрации Зендея Смотреть фильмы и сериалы онлайн в хорошем качестве 720p hd и без регистрации Удачи друзья!

canadian pharmacies online - Dec. 13, 2023, 1 a.m.

- I have read so many articles or reviews concerning the blogger lovers except this piece of writing is actually a fastidious paragraph, keep it up.

pharmacies - Dec. 13, 2023, 1:30 a.m.

- pharmacy in canada [url=https://canadianpharmacy.maweb.eu/#]viagra generic canadian pharmacy [/url] canada pharmaceuticals <a href="https://canadianpharmacy.maweb.eu/#">online order medicine </a> navarro pharmacy https://canadianpharmacy.maweb.eu/

Bradleyapege - Dec. 13, 2023, 6:35 a.m.

- Добрый день Обучаете аудиторию на рынке Форекс? Рады предложить Вам уникальное предложение, в рамках промо акции - с 01.12.23 по по 01.04.24 ровно четыре месяца! ******* Продается Брокерская Компания, торговый сервер MetaTrader4 с Бессрочной и Безлимитной лицензией до 2038 года. Цена: 27900 Евро ******* Полная передача программного обеспечения клиенту: MetaTrader4 Server MetaTrader4 Администратор MetaTrader4 Менеджер MetaTrader4 Клиент Торговый Server MetaTrader4 под ключ, продажа, аренда, лицензия Дарим премиальный Web портал Форекс Брокера стоимостью: 25 000 Евро Дарим серверные плагины MetaTrader4 стоимостью: 18 000 Евро ******* Бесплатные консультации: RUS https://salemt4srv.ru ENG https://hi-tech-fx.com ******* Skype:g.i.790 Е-mail: salemt4srv@gmail.com WhatsApp: +370 643 03708 ******* Скачать Virtual_Dealer_plugin_MetaTrader4 https://salemt4srv.ru/Virtual_Dealer_plugin_MetaTrader4.pdf ******* Download the trading MetaTrader 4server https://drive.google.com/file/d/10ZqvhfGUy-ByS-sD5Di2ukba2Q5wKPXG/view?usp=sharing We are open to cooperation! [url=http://salemt4srv.ru]Buy MT4 Forex Trading Server[/url] [url=http://salemt4srv.ru]Forex trading server for sale MetaTrader 4[/url] [url=http://salemt4srv.ru]Forex MetaTrader 4 Trading Server for Sale[/url] [url=http://salemt4srv.ru]Buy a turnkey Forex Dealing Center[/url] ***** Rent an MT4 Forex Trading Server Buy a turnkey Forex Dealing Center Buy a turnkey Forex Dealing Center Open a Forex brokerage company

pharmacy - Dec. 13, 2023, 6:46 a.m.

- canadian pharmacy online viagra [url=https://canadianpharmacy.maweb.eu/#]pharmacy uk [/url] canadian pharmaceuticals <a href="https://canadianpharmacy.maweb.eu/#">best canadian online pharmacies </a> canada pharmaceuticals online https://canadianpharmacy.maweb.eu/

pharmacies shipping to usa - Dec. 13, 2023, 9:15 a.m.

- canadian drugs pharmacy [url=https://canadianpharmacy.maweb.eu/#]canada pharmacy [/url] canada pharmaceuticals online generic <a href="https://canadianpharmacy.maweb.eu/#">online pharmacy </a> on line pharmacy https://canadianpharmacy.maweb.eu/

canadian pharmacies - Dec. 13, 2023, 4:56 p.m.

- 24 hour pharmacy [url=https://canadianpharmacy.maweb.eu/#]pharmacy discount [/url] canada discount drug <a href="https://canadianpharmacy.maweb.eu/#">canadian pharmacies online </a> pharmacy online no prescription https://canadianpharmacy.maweb.eu/

canadian pharmacies shipping to usa - Dec. 13, 2023, 10:56 p.m.

- Howdy! Do you use Twitter? I'd like to follow you if that would be ok. I'm undoubtedly enjoying your blog and look forward to new updates.

utaletaktd - Dec. 14, 2023, 4:59 a.m.

- buy cialis pills online cialis sicuro online forum [url=https://healtthexxpress.com/]cialis 20 mg[/url] 10 mg cialis does cialis daily work

online pharmacies canada - Dec. 14, 2023, 6:44 a.m.

- online pharmacies [url=https://canadianpharmacy.maweb.eu/#]pharmacy online prescription [/url] canadian online pharmacies <a href="https://canadianpharmacy.maweb.eu/#">online medicine to buy </a> canada pharmaceuticals https://canadianpharmacy.maweb.eu/

mirsHeilt - Dec. 14, 2023, 10:17 a.m.

- [url=https://nur-house.ru/doma]строительство дома под ключ[/url] или [url=https://nur-house.ru/doma]строительство дома под ключ цена[/url] [url=https://nur-house.ru/doma-iz-brusa]сруб из профилированного бруса[/url] https://nur-house.ru/karkasnie-doma

btaletdqkh - Dec. 14, 2023, 11:13 p.m.

- viagra prescription online comprare viagra online in contrassegno [url=https://pharmicasssale.com/]buy viagra los angeles[/url] viagra generico prezzo farmacia viagra generico con pagamento contrassegno

online pharmacies in usa - Dec. 15, 2023, 3:59 a.m.

- I absolutely love your blog and find a lot of your post's to be just what I'm looking for. can you offer guest writers to write content for you personally? I wouldn't mind producing a post or elaborating on a few of the subjects you write in relation to here. Again, awesome web log!

canada online pharmacies - Dec. 15, 2023, 7:45 a.m.

- pharmacy drugstore online [url=https://canadianpharmacy.maweb.eu/#]canadian drugs [/url] discount canadian drugs <a href="https://canadianpharmacy.maweb.eu/#">online medicine shopping </a> canadian viagra generic pharmacy https://canadianpharmacy.maweb.eu/

canadian online pharmacy - Dec. 15, 2023, 10:09 a.m.

- I'm not sure why but this blog is loading extremely slow for me. Is anyone else having this problem or is it a issue on my end? I'll check back later on and see if the problem still exists.

canadian online pharmacies - Dec. 16, 2023, 2:24 a.m.

- Howdy! This is kind of off topic but I need some advice from an established blog. Is it hard to set up your own blog? I'm not very techincal but I can figure things out pretty fast. I'm thinking about creating my own but I'm not sure where to begin. Do you have any ideas or suggestions? Appreciate it

pharmacies - Dec. 16, 2023, 3:12 p.m.

- walmart pharmacy online [url=https://canadianpharmacy.maweb.eu/#]canada pharmacies [/url] canada pharmaceuticals online generic <a href="https://canadianpharmacy.maweb.eu/#">canadian pharmacy generic viagra </a> online drugstore pharmacy https://canadianpharmacy.maweb.eu/

ltaletiqah - Dec. 16, 2023, 10:25 p.m.

- do u need a prescription for cialis cialis online kaufen per nachnahme [url=https://lloydspharmacytopss.com/]cialis daily cost[/url] cialis generico italia online cialis daily coupon

online pharmacies canada - Dec. 17, 2023, 12:03 a.m.

- canadian pharmacy online [url=https://canadianpharmacy.maweb.eu/#]canadian pharmacies online [/url] online drugstore pharmacy <a href="https://canadianpharmacy.maweb.eu/#">canadian pharmacy online </a> canada pharmacy online https://canadianpharmacy.maweb.eu/

Williamkek - Dec. 17, 2023, 12:14 a.m.

- <a href="https://guard-car.ru/">https://guard-car.ru/</a>

prescriptions online - Dec. 17, 2023, 4:55 a.m.

- generic viagra online pharmacy [url=https://canadianpharmacy.maweb.eu/#]canadian pharmacies online [/url] shoppers drug mart pharmacy <a href="https://canadianpharmacy.maweb.eu/#">canadian drugs </a> canada drugs pharmacy https://canadianpharmacy.maweb.eu/

on line pharmacy - Dec. 17, 2023, 7:22 a.m.

- shoppers drug mart pharmacy [url=https://canadianpharmacy.maweb.eu/#]canadian pharmacy review [/url] pharmacy online <a href="https://canadianpharmacy.maweb.eu/#">aarp recommended canadian pharmacies </a> canadian pharcharmy online https://canadianpharmacy.maweb.eu/

pharmacie - Dec. 17, 2023, 10:46 a.m.

- There's definately a great deal to know about this subject. I love all of the points you've made.

canada drugs online - Dec. 17, 2023, 5:02 p.m.

- I simply could not go away your web site before suggesting that I really enjoyed the usual info an individual supply in your visitors? Is going to be again often to inspect new posts

ctaletylqh - Dec. 18, 2023, 1:18 a.m.

- visual analysis essay examples [url=https://essaydw.com/]mba essay help[/url] essay type sample mba essay https://essaydw.com/ - can you buy essays online

canadian pharmacies - Dec. 18, 2023, 3:24 a.m.

- I am not sure where you're getting your info, but good topic. I needs to spend some time learning more or understanding more. Thanks for magnificent info I was looking for this information for my mission.

bziHeilt - Dec. 18, 2023, 12:21 p.m.

- [url=https://brand-wear.ru/2023/12/14/zhenskie-kostyumy-v-moskve-msk-brands-ru-shirokiy-vybor-modeley/]купить женские костюмы[/url] или [url=https://brand-wear.ru/2023/12/14/kupit-modnye-zhenskie-futbolki-v-moskve-msk-brands/]купить женские футболки[/url] [url=https://odezhdalux.ru/novosti/37-internet-magazin-msk-brandsru-muzhskie-rubashki-v-moskve-luchshie-ceny-i-kachestvo.html]купить мужские рубашки[/url] https://odezhdalux.ru/novosti/24-moskva-zhenskaja-odezhda-ot-msk-brands-stil-i-kachestvo-v-kazhdoj-detali.html Ещё можно узнать: [url=http://yourdesires.ru/beauty-and-health/1568-kompleks-mikocin-izbavit-ot-gribka-vsego-za-30-dnej-i-ne-dopustit-povtornogo-zarazhenija.html]микоцин мазь от грибка[/url] купить женские футболки

canadian drugs online pharmacy - Dec. 19, 2023, 1:48 a.m.

- Hmm it appears like your website ate my first comment (it was extremely long) so I guess I'll just sum it up what I wrote and say, I'm thoroughly enjoying your blog. I as well am an aspiring blog writer but I'm still new to the whole thing. Do you have any points for inexperienced blog writers? I'd certainly appreciate it.

cheap pharmacy online - Dec. 19, 2023, 9:14 a.m.

- Wow, amazing weblog structure! How long have you been running a blog for? you make running a blog look easy. The overall look of your website is magnificent, as smartly as the content material!

Georgehal - Dec. 19, 2023, 9:53 a.m.

- interesting news _________________ [URL=https://kzkk42.site/3107.html]казинолық Барселона орналасқан[/URL]

mexican pharmacies - Dec. 19, 2023, 3:35 p.m.

- I do trust all the concepts you've offered for your post. They are really convincing and can certainly work. Still, the posts are very short for beginners. Could you please lengthen them a bit from subsequent time? Thanks for the post.

canadian pharmacy online viagra - Dec. 19, 2023, 11:09 p.m.

- It's remarkable to visit this website and reading the views of all colleagues about this article, while I am also zealous of getting know-how.

pharmacies online - Dec. 20, 2023, 3:42 a.m.

- I visited various websites but the audio feature for audio songs existing at this site is in fact excellent.

pharmacy online drugstore - Dec. 20, 2023, 8:26 a.m.

- Thanks for another wonderful post. The place else may just anyone get that type of info in such a perfect means of writing? I've a presentation next week, and I am on the search for such info.

24 hour pharmacy - Dec. 20, 2023, 1:04 p.m.

- My brother suggested I may like this website. He used to be entirely right. This put up truly made my day. You cann't imagine just how a lot time I had spent for this info! Thank you!

ptaletboqk - Dec. 20, 2023, 7:30 p.m.

- how is cialis different from viagra viagra cialis online prescriptions [url=https://doctorrvipfox.com/]cialis dosage[/url] buy cialis soft tabs women take cialis

compound pharmacy - Dec. 20, 2023, 11:22 p.m.

- After I initially commented I appear to have clicked the -Notify me when new comments are added- checkbox and now whenever a comment is added I receive four emails with the same comment. Is there a means you are able to remove me from that service? Thanks a lot!

walgreens pharmacy online - Dec. 21, 2023, 1:44 a.m.

- Way cool! Some very valid points! I appreciate you penning this article and also the rest of the site is really good.

Danielknode - Dec. 21, 2023, 2:11 a.m.

- Доброго Уделяли ли Вы внимание выбору доменного имени? Это очень важно, имя для проекта или сайта это как имя человека на всю жизнь! Недавно наша компания искала себе короткое и созвучное имя, удалось купить отличный вариант после некоторого времени поиска, не так и дорого для такого имени из 4 символов. Кстати там еще остались имена, посмотрите если будет интересно, вот профиль продавца) https://www.reg.ru/domain/shop/lots-by-seller/1699910 Мы провели сделку через регистратор, все 100% защищенно и без сложностей, мгновенное онлайн переоформление) Удачи!

canadian pharmaceuticals - Dec. 21, 2023, 6:47 a.m.

- Hi to all, the contents present at this website are actually remarkable for people experience, well, keep up the nice work fellows.

canadian drugs online pharmacy - Dec. 21, 2023, 1:38 p.m.

- Wow, wonderful weblog layout! How long have you ever been running a blog for? you made running a blog look easy. The entire look of your site is fantastic, let alone the content material!

canadian pharcharmy - Dec. 21, 2023, 4:10 p.m.

- whoah this weblog is wonderful i love reading your articles. Stay up the great work! You know, a lot of individuals are searching round for this information, you can aid them greatly.

online pharmacies canada - Dec. 21, 2023, 5:53 p.m.

- Thanks for finally talking about > %blog_title% < Loved it!

pharmacy online cheap - Dec. 21, 2023, 8:19 p.m.

- Asking questions are truly fastidious thing if you are not understanding anything completely, however this paragraph provides pleasant understanding even.

canadian viagra - Dec. 22, 2023, 12:22 p.m.

- Valuable info. Lucky me I discovered your website unintentionally, and I am stunned why this accident did not took place in advance! I bookmarked it.

Johnameri - Dec. 22, 2023, 2:14 p.m.

- Лучшие онлайн-казино на 2024 год. Лучшие сайты для бесплатных и реальных азартных игр на [url=https://спецтехника-ск.рф/]Игровые автоматы играть без регистрации демо[/url] [url=https://prodatkupitlekarstva.ru/]Сайты казино[/url] [url=https://websharks.ru/]Промокоды казино[/url] [url=https://steam-team.ru/]Играть казино[/url] [url=https://inside-center.ru/]Казино с выводом[/url] [url=https://попутныегрузоперевозки.рф/]Онлайн казино[/url] [url=https://салоноранж.рф/]Проверенные казино[/url] [url=https://выкупкар24.рф/]Казино на рубли[/url] [url=https://professional59.ru/]Казино онлайн[/url] [url=https://syndicateoftraders.ru/]Лучшие казино[/url] [url=https://npo-es.ru/]Рейтинг казино[/url]

panacea pharmacy - Dec. 22, 2023, 4:43 p.m.

- Hi there to every one, since I am actually eager of reading this web site's post to be updated daily. It contains fastidious material.

canadian pharcharmy online - Dec. 23, 2023, 4:34 a.m.

- Hey just wanted to give you a brief heads up and let you know a few of the images aren't loading properly. I'm not sure why but I think its a linking issue. I've tried it in two different web browsers and both show the same results.

ktaletljjh - Dec. 23, 2023, 7:25 a.m.

- essay on help <a href=https://essaydw.com/>buying online essays</a> examples of literary analysis essays how to right essay https://essaydw.com/ - pay to do my essay

gtaletplaw - Dec. 23, 2023, 3:40 p.m.

- how to get cialis free how much is a cialis pill [url=https://lloydspharmacytopss.com/]cheapest cialis usa[/url] order discount cialis online cialis daily cost

pharmacy discount - Dec. 23, 2023, 5:49 p.m.

- It's nearly impossible to find educated people about this topic, but you seem like you know what you're talking about! Thanks

JeffreyCor - Dec. 24, 2023, 7:33 a.m.

- Thanks, + _________________ https://Bangladeshbetting.site

panacea pharmacy - Dec. 24, 2023, 1:05 p.m.

- I'm really enjoying the theme/design of your weblog. Do you ever run into any browser compatibility issues? A number of my blog audience have complained about my blog not operating correctly in Explorer but looks great in Opera. Do you have any solutions to help fix this issue?

shoppers drug mart canada - Dec. 24, 2023, 9:20 p.m.

- Hello, I desire to subscribe for this web site to get hottest updates, therefore where can i do it please assist.

online pharmacies canada - Dec. 25, 2023, 11:51 a.m.

- Great beat ! I wish to apprentice while you amend your web site, how could i subscribe for a blog website? The account helped me a acceptable deal. I had been tiny bit acquainted of this your broadcast provided bright clear idea

canadian pharmacy online - Dec. 25, 2023, 4:14 p.m.

- Hi everyone, it's my first pay a quick visit at this website, and post is actually fruitful in favor of me, keep up posting these types of articles.

Rogatony - Dec. 25, 2023, 7:57 p.m.

- Get a glimpse of the real picture of the war in Ukraine. Witness the battles firsthand. Discover: How territories are cleared from the enemy. How drones drop explosives on soldiers, bunkers, and military tanks. How kamikaze drones destroy vehicles and buildings. Tank firing on infantry and military machinery. This is unique content that won't be shown on TV. Link to Channel: <HOT INSIDE NEWS> https://t.me/+PhiArK2oSvU4N2Iy

national pharmacies online - Dec. 25, 2023, 11:29 p.m.

- Nice weblog right here! Also your web site rather a lot up fast! What web host are you the usage of? Can I get your associate link to your host? I desire my web site loaded up as fast as yours lol

canadian government approved pharmacies - Dec. 26, 2023, 2:44 a.m.

- I am regular visitor, how are you everybody? This paragraph posted at this site is truly good.

pharmacy intern - Dec. 26, 2023, 7:41 a.m.

- As the admin of this web site is working, no hesitation very shortly it will be renowned, due to its quality contents.

canadia online pharmacy - Dec. 26, 2023, 12:47 p.m.

- An outstanding share! I've just forwarded this onto a friend who had been conducting a little research on this. And he in fact bought me lunch due to the fact that I stumbled upon it for him... lol. So allow me to reword this.... Thank YOU for the meal!! But yeah, thanks for spending some time to talk about this issue here on your site.

canadian pharmacy online viagra - Dec. 26, 2023, 8:31 p.m.

- Superb post but I was wanting to know if you could write a litte more on this subject? I'd be very thankful if you could elaborate a little bit more. Thank you!

canadia online pharmacy - Dec. 27, 2023, 3:35 a.m.

- Thank you for the auspicious writeup. It in fact was a amusement account it. Look advanced to more added agreeable from you! However, how could we communicate?

shoppers drug mart canada - Dec. 27, 2023, 1:30 p.m.

- Hey, I think your website might be having browser compatibility issues. When I look at your blog in Safari, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, superb blog!

approved canadian online pharmacies - Dec. 27, 2023, 9:49 p.m.

- Hi friends, its wonderful article concerning teachingand completely defined, keep it up all the time.

canadian pharmacy - Dec. 28, 2023, 12:08 a.m.

- Why viewers still use to read news papers when in this technological world the whole thing is accessible on net?

dtaletfbyl - Dec. 28, 2023, 6:13 a.m.

- do i need a prescription for cialis [url=https://cialisbag.com/]online prescription for cialis[/url] cost of cialis 5mg cialis daily review https://cialisbag.com/ - canadian cialis online

shoppers drug mart canada - Dec. 28, 2023, 2:19 p.m.

- Hi everyone, it's my first pay a visit at this web site, and piece of writing is actually fruitful in favor of me, keep up posting these posts.

cialis pharmacy online - Dec. 28, 2023, 5:45 p.m.

- It's an remarkable paragraph in support of all the web people; they will obtain benefit from it I am sure.

online drugstore - Dec. 29, 2023, 12:52 p.m.

- Hurrah, that's what I was seeking for, what a information! existing here at this blog, thanks admin of this website.

italetyquz - Dec. 30, 2023, 12:52 a.m.

- viagra cialis levitra comparisons [url=https://cialisbag.com/]cialis price[/url] canada pharmacy cialis cialis samples free https://cialisbag.com/ - cialis from canadian pharmacies

pharmacy cheap no prescription - Dec. 30, 2023, 5:21 a.m.

- Greate post. Keep writing such kind of information on your page. Im really impressed by it. Hi there, You have done a fantastic job. I'll certainly digg it and personally suggest to my friends. I'm confident they will be benefited from this site.

online pharmacies of canada - Dec. 30, 2023, 8:48 p.m.

- Do you have a spam problem on this site; I also am a blogger, and I was wanting to know your situation; many of us have created some nice practices and we are looking to trade solutions with others, why not shoot me an email if interested.

buy viagra pharmacy 100mg - Dec. 31, 2023, 6:47 a.m.

- You are so cool! I do not believe I've truly read something like that before. So great to discover another person with original thoughts on this subject. Seriously.. many thanks for starting this up. This website is one thing that's needed on the internet, someone with a little originality!

canadian pharmacy review - Dec. 31, 2023, 11:21 p.m.

- I was excited to find this website. I wanted to thank you for ones time due to this wonderful read!! I definitely savored every part of it and i also have you book-marked to look at new information on your web site.

discount pharmacies - Jan. 1, 2024, 8:48 a.m.

- Hey There. I found your blog using msn. This is an extremely well written article. I'll make sure to bookmark it and return to read more of your useful information. Thanks for the post. I will definitely return.

pharmacy drugstore online - Jan. 2, 2024, 5:39 a.m.

- Hello there! Do you know if they make any plugins to assist with Search Engine Optimization? I'm trying to get my blog to rank for some targeted keywords but I'm not seeing very good success. If you know of any please share. Cheers!

canadia online pharmacy - Jan. 2, 2024, 8:42 a.m.

- What's up, yes this article is really good and I have learned lot of things from it on the topic of blogging. thanks.

pharmacy drugstore online - Jan. 2, 2024, 12:05 p.m.

- I'd like to find out more? I'd like to find out some additional information.

prokat-meteor_cuOr - Jan. 3, 2024, 4:39 a.m.

- Аренда инструмента в Поработать с инструментом без У нас доступны новейшие модели Лучшее решение для домашнего ремонта инструмент доступно в нашем сервисе Арендовать инструмента мелких задач Сберегайте деньги на покупке инструмента с нашими услугами проката Правильное решение для У вас нет инструмента? Не проблема, на наш сервис за инструментом! Расширьте свои возможности с качественным инструментом из нашего сервиса Прокат инструмента для садовых работ Не тяните деньги на покупку инструмента, а арендуйте инструмент для любых задач в наличии Большой выбор инструмента для проведения различных работ Качественная помощь в выборе нужного инструмента от знатоков нашей компании Выгодно с услугами проката инструмента для отделки дома или квартиры Наша команда – надежный партнер в аренде инструмента Надежный помощник для ремонтных работ – в нашем прокате инструмента Не знаете, какой инструмент подойдет? Мы поможем с выбором инструмента в нашем сервисе. аренда строительного электроинструмента [url=http://www.meteor-perm.ru/]http://www.meteor-perm.ru/[/url].

canadia online pharmacy - Jan. 3, 2024, 10:57 a.m.

- This piece of writing gives clear idea designed for the new viewers of blogging, that in fact how to do blogging.

viagra pharmacy 100mg - Jan. 4, 2024, 1:08 a.m.

- At this time it looks like Drupal is the top blogging platform out there right now. (from what I've read) Is that what you are using on your blog?

canadian pharcharmy - Jan. 4, 2024, 3:45 a.m.

- I will immediately grab your rss feed as I can not in finding your email subscription hyperlink or newsletter service. Do you've any? Kindly allow me recognise in order that I may just subscribe. Thanks.

IlonaviB - Jan. 4, 2024, 9:24 a.m.

- Всем привет! Что, по вашему мнению, помогает разбавить жизненную рутину? Дает возможность отвлечься от ежедневных забот, вырваться из топкой затягивающей обыденности? Что заставляет Вас испытывать яркие эмоции? Возможно любимое хобби, спорт, путешествия, экстремальный вид отдыха. А может Вы получаете незабываемый восторг от экзотической и не тривиальной кухни или просто обожаете готовить, радовать домочадцев шедеврами кулинарии. Но, согласитесь, что нынешний ритм диктует свои условия и порой на отличное времяпрепровождение нет времени, сил, а финансовая составляющая ставит перед выбором. Кино - лучший вариант. Искусство большого экрана стало частью нашей жизни и порой мы не замечаем, когда они становятся частью каждого. Сайты кишат широким ассортиментом кинематографа. Зачастую, многие кинотеатры, для того чтоб открыть нам разрешение к обзору киноленты требуют регистрации, оплаты за контент или просто ограничивают доступ в определённых территориях. Знакомо, да? Хочу посоветовать проект, который для меня стал открытием - https://hd-rezka.cc. Почему находка? Во-первых, минимум рекламы. Во-вторых, существует «стол заказов» где можно оставить отзыв какой фильм вы бы хотели посмотреть. И самое главное, там нет контента, который «...недоступен для вашего региона...» или «...ограничено для просмотра...». Просто захожу и получаю наслаждение от просмотра. Чего и вам желаю) Кстати вот интересные разделы! [url=Biscarte Hazencruz Смотреть фильмы и сериалы онлайн в хорошем качестве 720p hd и без регистрации]https://hd-rezka.cc/actors/Biscarte%20Hazencruz/[/url] [url=Кори Джонсон Смотреть фильмы и сериалы онлайн в хорошем качестве 720p hd и без регистрации]https://hd-rezka.cc/actors/%D0%9A%D0%BE%D1%80%D0%B8%20%D0%94%D0%B6%D0%BE%D0%BD%D1%81%D0%BE%D0%BD/[/url] [url=Моя земля смотреть онлайн бесплатно (2015) в хорошем качестве]https://hd-rezka.cc/films/12186-moja-zemlja-2015.html[/url] [url=Артемий Егоров Смотреть фильмы и сериалы онлайн в хорошем качестве 720p hd и без регистрации]https://hd-rezka.cc/actors/%D0%90%D1%80%D1%82%D0%B5%D0%BC%D0%B8%D0%B9%20%D0%95%D0%B3%D0%BE%D1%80%D0%BE%D0%B2/[/url] [url=Рун Фу Смотреть фильмы и сериалы онлайн в хорошем качестве 720p hd и без регистрации]https://hd-rezka.cc/actors/%D0%A0%D1%83%D0%BD%20%D0%A4%D1%83/[/url] Исторические мультфильмы - смотреть онлайн бесплатно в хорошем качестве Дочь смотреть онлайн бесплатно (2021) в хорошем качестве Бывшая смотреть онлайн бесплатно (2021) в хорошем качестве Оливия-Мэй Барретт Смотреть фильмы и сериалы онлайн в хорошем качестве 720p hd и без регистрации Лучшие фантастики 2023 года Лиза Колон-Зайас Смотреть фильмы и сериалы онлайн в хорошем качестве 720p hd и без регистрации Месть земли смотреть онлайн бесплатно (2021) в хорошем качестве Карэн Бадалов Смотреть фильмы и сериалы онлайн в хорошем качестве 720p hd и без регистрации Удачи друзья!

buy generic viagra online - Jan. 4, 2024, 9:35 a.m.

- Good day! This is kind of off topic but I need some guidance from an established blog. Is it tough to set up your own blog? I'm not very techincal but I can figure things out pretty fast. I'm thinking about making my own but I'm not sure where to start. Do you have any tips or suggestions? Appreciate it

generic viagra online - Jan. 4, 2024, 3:30 p.m.

- I absolutely love your blog and find a lot of your post's to be what precisely I'm looking for. Would you offer guest writers to write content to suit your needs? I wouldn't mind creating a post or elaborating on most of the subjects you write concerning here. Again, awesome weblog!

ntaletawsm - Jan. 4, 2024, 6:24 p.m.

- where to buy the cheapest cialis <a href=https://cialisbag.com/>cialis low price</a> cialis meaning do you need a prescription for cialis https://cialisbag.com/ - discount cialis

canadian cialis - Jan. 5, 2024, 6:29 a.m.

- My spouse and I stumbled over here coming from a different page and thought I may as well check things out. I like what I see so now i'm following you. Look forward to looking at your web page yet again.

urist_xodreaskapope - Jan. 5, 2024, 12:54 p.m.

- консультации юриста бесплатно для всех вопросов о законодательстве|юридическое обслуживание бесплатно на законодательные темы Юридическая консультация бесплатно для граждан и предприятий по разнообразным вопросам Получи бесплатную юридическую консультацию от Бесплатная консультация юриста: решение юридических вопросов|Получи бесплатное консультирование от лучших юристов по наболевшим проблемам Получи бесплатную юридическую консультацию о расчете имущества помощь юриста бесплатно [url=https://konsultaciya-yurista-499.ru/]https://konsultaciya-yurista-499.ru/[/url].

discount pharmacy - Jan. 6, 2024, 1:10 p.m.

- Very good article. I will be experiencing many of these issues as well..

cheap prescription drugs - Jan. 7, 2024, 2:09 a.m.

- Incredible points. Solid arguments. Keep up the great spirit.

canada discount drug - Jan. 7, 2024, 2:11 a.m.

- Hello, i believe that i saw you visited my blog thus i came to go back the choose?.I'm attempting to in finding issues to enhance my web site!I assume its good enough to use a few of your ideas!!

canada drugs pharmacy online - Jan. 7, 2024, 11:07 p.m.

- great points altogether, you simply gained a emblem new reader. What might you recommend in regards to your submit that you simply made some days ago? Any sure?

bziHeilt - Jan. 8, 2024, 2:24 a.m.

- [url=https://msk-brands.ru/2023/12/14/zhenskie-svitera-v-moskve-ot-msk-brands-stilnye-i-uyutnye-modeli/]купить женский свитер[/url] или [url=https://msk-brands.ru/2023/12/14/zhenskaya-verhnyaya-odezhda-v-moskve-ot-msk-brands-stilnye-modeli-kachestvennye-materialy/]купить верхнюю женскую одежду[/url] [url=https://brand-m.ru/service/30-internet-magazin-msk-brandsru-muzhskie-rubashki-v-moskve-luchshie-ceny-i-kachestvo.html]купить мужские рубашки[/url] https://brand-wear.ru/2023/12/14/zhenskie-kostyumy-v-moskve-msk-brands-ru-shirokiy-vybor-modeley/ Ещё можно узнать: [url=http://yourdesires.ru/it/windows/29-sbros-parametrov-brauzera-internet-explorer.html]ie настройки по умолчанию[/url] кроссовки женские брендовые

canadian pharmacies-24h - Jan. 8, 2024, 3:50 a.m.

- Link exchange is nothing else however it is only placing the other person's website link on your page at proper place and other person will also do same in support of you.

online pharmacies uk - Jan. 8, 2024, 7:38 a.m.

- Having read this I believed it was extremely informative. I appreciate you spending some time and effort to put this information together. I once again find myself personally spending a significant amount of time both reading and leaving comments. But so what, it was still worth it!

shoppers drug mart pharmacy - Jan. 8, 2024, 11:24 a.m.

- This paragraph is truly a pleasant one it helps new internet people, who are wishing in favor of blogging.

stromectol in india - Jan. 8, 2024, 12:01 p.m.

- Hello there! I know this is kinda off topic but I'd figured I'd ask. Would you be interested in trading links or maybe guest writing a blog article or vice-versa? My site discusses a lot of the same topics as yours and I believe we could greatly benefit from each other. If you are interested feel free to send me an email. I look forward to hearing from you! Wonderful blog by the way!

canadia online pharmacy - Jan. 8, 2024, 1:34 p.m.

- When I initially commented I clicked the "Notify me when new comments are added" checkbox and now each time a comment is added I get four e-mails with the same comment. Is there any way you can remove me from that service? Many thanks!

buying stromectol online - Jan. 8, 2024, 4:54 p.m.

- Thank you a bunch for sharing this with all people you actually realize what you are talking approximately! Bookmarked. Please also seek advice from my web site =). We could have a hyperlink trade contract between us

medicaments stromectol - Jan. 8, 2024, 9:52 p.m.

- Pretty great post. I just stumbled upon your weblog and wanted to mention that I have really enjoyed surfing around your weblog posts. After all I'll be subscribing for your rss feed and I am hoping you write once more soon!

yurist_fasa - Jan. 9, 2024, 12:56 a.m.

- Судебные споры о наследстве сколько нотариус оформляет наследство [url=http://www.yurist-po-nasledstvu-msk-mo.ru/]http://www.yurist-po-nasledstvu-msk-mo.ru/[/url] .

stromectol brasilien - Jan. 9, 2024, 2:24 a.m.

- Asking questions are actually good thing if you are not understanding something completely, except this paragraph presents nice understanding even.

stromectol drug - Jan. 9, 2024, 6:49 a.m.

- Hi, i think that i saw you visited my website so i came to “return the favor”.I'm attempting to find things to improve my website!I suppose its ok to use some of your ideas!!

rog - Jan. 9, 2024, 10:07 a.m.

- I want to show you one exclusive software called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man, and maybe even a billionaire! This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet! Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold! Remember the more computers you use, the higher your chances of getting the treasure! Thank me by donating if you have the opportunity. Free Download: https://t.me/+5ofvqnKhLrw0YTdi

stromectol france - Jan. 9, 2024, 10:56 a.m.

- Nice weblog right here! Additionally your site lots up very fast! What host are you using? Can I am getting your affiliate link for your host? I wish my site loaded up as quickly as yours lol

national pharmacies - Jan. 9, 2024, 1:50 p.m.

- Hello my family member! I want to say that this post is amazing, great written and include almost all significant infos. I would like to see more posts like this .

stromectol scabies treatment - Jan. 9, 2024, 2:53 p.m.

- We absolutely love your blog and find a lot of your post's to be just what I'm looking for. Do you offer guest writers to write content available for you? I wouldn't mind composing a post or elaborating on some of the subjects you write with regards to here. Again, awesome web site!

canadian pharcharmy online - Jan. 9, 2024, 5:04 p.m.

- Thanks very nice blog!

ivermectin tablets - Jan. 9, 2024, 7:15 p.m.

- It's an amazing paragraph in favor of all the internet viewers; they will obtain benefit from it I am sure.

mziHeilt - Jan. 9, 2024, 9:42 p.m.

- [url=https://med-klinika163.ru/index.php?newsid=31]медикаментозное прерывание беременности[/url] или [url=https://clinika-med.ru/oformlenie-spravok]Оформление справок в Самаре[/url] [url=https://clinika-med.ru/priem-dermatologa]прием дерматолога в Самаре[/url] https://clinika-med.ru/uzi Ещё можно узнать: [url=http://yourdesires.ru/fashion-and-style/quality-of-life/1317-chto-takoe-azartnye-igry-v-internete.html]онлайн азартные игры что это[/url] прием гинеколога

dosage for stromectol - Jan. 9, 2024, 11:37 p.m.

- Remarkable! Its really awesome paragraph, I have got much clear idea regarding from this piece of writing.

london drugs canada - Jan. 9, 2024, 11:53 p.m.

- Greetings! I've been reading your web site for some time now and finally got the bravery to go ahead and give you a shout out from Dallas Tx! Just wanted to mention keep up the good work!

rtaletitfl - Jan. 10, 2024, 12:48 a.m.

- cialis tablete buy cialis 30 mg [url=https://nwvipphysicians.com/]best price on cialis 20mg[/url] buy cialis online prescription best way to take cialis for best results

facts stromectol - Jan. 10, 2024, 4:03 a.m.

- Can I simply just say what a comfort to uncover somebody that genuinely knows what they are talking about on the net. You actually know how to bring an issue to light and make it important. A lot more people must read this and understand this side of your story. I was surprised you're not more popular because you certainly possess the gift.

canadian drugstore - Jan. 10, 2024, 10:39 a.m.

- Thanks for your personal marvelous posting! I seriously enjoyed reading it, you happen to be a great author.I will make sure to bookmark your blog and will eventually come back sometime soon. I want to encourage you to ultimately continue your great job, have a nice morning!

best online canadian pharmacy - Jan. 10, 2024, 1:58 p.m.

- obviously like your web-site but you need to take a look at the spelling on several of your posts. A number of them are rife with spelling issues and I to find it very troublesome to tell the reality on the other hand I will definitely come back again.

KathryngeAse - Jan. 10, 2024, 2:52 p.m.

- Приглашаем Ваше предприятие к взаимовыгодному сотрудничеству в направлении производства и поставки [url=] РљСЂСѓРі РРџ437 [/url] и изделий из него. - Поставка концентратов, и оксидов - Поставка изделий производственно-технического назначения (труба). - Любые типоразмеры, изготовление по чертежам и спецификациям заказчика. [url=https://redmetsplav.ru/store/nikel1/rossiyskie_materialy/ep/ep437/krug_ep437/ ][img][/img][/url] fa84385

KathryngeAse - Jan. 10, 2024, 2:54 p.m.

- Приглашаем Ваше предприятие к взаимовыгодному сотрудничеству в направлении производства и поставки никелевого сплава [url=https://redmetsplav.ru/store/nikel1/zarubezhnye_materialy/germaniya/cat2.4555/ ] Проволока 2.4555 [/url] и изделий из него. - Поставка порошков, и оксидов - Поставка изделий производственно-технического назначения (чаши). - Любые типоразмеры, изготовление по чертежам и спецификациям заказчика. [url=https://redmetsplav.ru/store/nikel1/zarubezhnye_materialy/germaniya/cat2.4555/ ][img][/img][/url] [url=https://demkrolik.ucoz.ru/publ/kokcidioz/1-1-0-27]сплав[/url] [url=https://sch48-a-class.ucoz.ru/news/forum_po_ehkologii_cvetushhaja_chuvashija/2011-10-29-88]сплав[/url] 2eb4d59

KathryngeAse - Jan. 10, 2024, 2:58 p.m.

- Приглашаем Ваше предприятие к взаимовыгодному сотрудничеству в сфере производства и поставки никелевого сплава [url=https://redmetsplav.ru/store/nikel1/rossiyskie_materialy/hn_1/hn65mvu-vi/ ] РҐРќ65РњР’РЈ-Р’Р [/url] и изделий из него. - Поставка концентратов, и оксидов - Поставка изделий производственно-технического назначения (квадрат). - Любые типоразмеры, изготовление по чертежам и спецификациям заказчика. [url=https://redmetsplav.ru/store/nikel1/rossiyskie_materialy/hn_1/hn65mvu-vi/ ][img][/img][/url] [url=http://www.mecosys.com/bbs/board.php?bo_table=project_02&wr_id=464217]сплав[/url] [url=http://kosteremok.ucoz.ru/news/poseshhenie_nravsvenno_patrioticheskogo_centra/2013-03-24-8]сплав[/url] 4385e75

Sheilakip - Jan. 10, 2024, 3:11 p.m.

- Компания РМС Екатеринбург — один из ведущих поставщиков редких металлов, включая вольфрам и молибден, и изделий из них. Существующие запасы редких металлов и современное оборудование обеспечивают нам возможность выполнения заказов любой сложности и объема, соблюдая самые высокие стандарты качества. Постоянное развитие и новации в технологиях помогают нам отвечать потребностям клиентов даже с самыми специфическими требованиями, при этом мы гарантируем надежность при каждой сделке благодаря нашему опыту и профессионализму. Наша продукция: [url=https://rms-ekb.ru/catalog/truba-tonkostennaia/truba-tonkostennaia-stalnaia-57kh2-mm-stal-10-gost-8734-75/]Труба тонкостенная стальная 57х2 мм сталь 10 ГОСТ 8734 - 75[/url] [url=https://rms-ekb.ru/catalog/zhily-tokoprovodiashchie/zhily-tokoprovodiashchie-cu-4x6-gost-22483-2012/]Жилы токопроводящие Cu 4x6 ГОСТ 22483-2012[/url] [url=https://rms-ekb.ru/catalog/ugolok-stalnoi/ugolok-stalnoi-15khsnd-75x60x7-gost-8509-93/]Уголок стальной 15ХСНД 75x60x7 ГОСТ 8509 - 93[/url] [url=https://rms-ekb.ru/catalog/khromel-list/khromel-list-nkhm9-4x500x1000-gost-492-73/]Хромель лист НХМ9 4x500x1000 ГОСТ 492-73[/url] [url=https://rms-ekb.ru/catalog/folga-latunnaia/folga-latunnaia-iuvelirnaia-ls59-1-0-05-mm-gost-2208-2007-v-rulonakh/]Фольга латунная ювелирная ЛС59-1 0.05 мм ГОСТ 2208 - 2007 в рулонах[/url]

RebeccaJeamb - Jan. 10, 2024, 3:13 p.m.

- На портале PKP-RMS - https://pkp-rms.ru, вы сможете подобрать из обширного каталога более 1000 продуктов. Наша компания - крупнейший поставщик в РФ, специализирующийся на поставке материалов наалучшего качества как для производственных, так и лабораторных целей. Наш каталог товаров - это обширный источник информации о товарах для вашего бизнеса. Наша продукция: - Диспрозий (III) бромид: https://pkp-rms.ru/catalog/neorganicheskie-soedineniia/disprozii-iii-bromid/ - Марганец: https://pkp-rms.ru/catalog/metally/marganets-1/ - Тулий (III) ацетат тетрагидрат: https://pkp-rms.ru/catalog/neorganicheskie-soedineniia/tulii-iii-atsetat-tetragidrat/ - Лантан (III) хлорид: https://pkp-rms.ru/catalog/neorganicheskie-soedineniia/lantan-iii-khlorid-2/ - Барий иодид: https://pkp-rms.ru/catalog/neorganicheskie-soedineniia/barii-iodid/

stromectol buy online - Jan. 10, 2024, 5:36 p.m.

- Asking questions are truly pleasant thing if you are not understanding something completely, but this piece of writing presents fastidious understanding yet.

canadian pharmaceuticals online safe - Jan. 10, 2024, 6:49 p.m.

- Hi there, I do believe your site may be having browser compatibility problems. When I look at your site in Safari, it looks fine however, if opening in I.E., it has some overlapping issues. I just wanted to provide you with a quick heads up! Other than that, wonderful blog!

WalterEpibe - Jan. 11, 2024, 3:47 a.m.

- Недавно встретился с сложностью продвижения сайта в интернет, и нашел дешовое рекламное агенство https://честная-реклама.рф/ Они предоставляют услуги по seo оптимизации сайтов https://честная-реклама.рф/seo-optimizacija-i-prodvizhenie-sajta/ выводят в на первые позиции поисковых систем Yandex Делают услуги по таргетированной рекламе Вконтакте https://честная-реклама.рф/target/ Делают контекстную рекламуhttps://честная-реклама.рф/vedenie-kontekstnoj-reklamy-yandeks-direkt/ У компании есть ряд кейсов с контактами клиента https://честная-реклама.рф/kejsy/ карта сайта https://честная-реклама.рф/page-sitemap.xml

stromectol scabies - Jan. 11, 2024, 6:38 a.m.

- I read this paragraph completely regarding the comparison of most recent and preceding technologies, it's awesome article.

canadian pharmaceuticals - Jan. 11, 2024, 8:21 a.m.

- naturally like your web-site however you have to check the spelling on quite a few of your posts. Several of them are rife with spelling problems and I find it very troublesome to inform the truth then again I will definitely come back again.

stromectol doses - Jan. 11, 2024, 10:59 a.m.

- magnificent submit, very informative. I wonder why the other specialists of this sector don't realize this. You should proceed your writing. I'm confident, you have a huge readers' base already!

Keithamabs - Jan. 11, 2024, 5:08 p.m.

- Simdi kaydolun [url=https://www.bitget.com/tr]https://www.bitget.com/tr[/url] ve 1000 USDT hos geldin paketi al?n!

stromectol pill - Jan. 11, 2024, 7:43 p.m.

- Hi there colleagues, how is everything, and what you would like to say concerning this paragraph, in my view its truly amazing in favor of me.

ivermectin dosage - Jan. 12, 2024, 12:03 a.m.

- Great article! This is the type of info that should be shared around the internet. Shame on Google for now not positioning this put up upper! Come on over and talk over with my website . Thanks =)

generic viagra online - Jan. 12, 2024, 4:45 a.m.

- Have you ever considered about adding a little bit more than just your articles? I mean, what you say is important and all. However just imagine if you added some great pictures or video clips to give your posts more, "pop"! Your content is excellent but with pics and clips, this website could certainly be one of the most beneficial in its field. Awesome blog!

IraBaw - Jan. 12, 2024, 5:50 a.m.

- Hello everybody! How do you feel about computer graphics and design? Once I started looking at the works of leading designers and it became my hobby, computer graphics allows you to do beautiful works, design solutions and advertising creatives. By the way, I noticed that it broadens my horizons, and brings peace to my life! I recommend profiles of these masters: https://dprofile.ru/tatyanaandreeva https://dprofile.ru/ef-fm/info https://dprofile.ru/elizatav https://dprofile.ru/bo_el https://dprofile.ru/anna.medoed/followers https://dprofile.ru/fedor93/following https://dprofile.ru/luchshev/info https://dprofile.ru/designem/following https://dprofile.ru/endy/followers https://dprofile.ru/krylyev/followers https://dprofile.ru/nadin.design https://dprofile.ru/lizaburlutska.ya https://dprofile.ru/polina_art/story/2 https://dprofile.ru/perchik/info https://dprofile.ru/bartoshds/followers https://dprofile.ru/ilyapro2000/following https://dprofile.ru/dsgn_ps/followers https://dprofile.ru/igorkh/following https://dprofile.ru/ygraficdesign https://dprofile.ru/kateko/following Good luck!

KathryngeAse - Jan. 12, 2024, 11:06 a.m.

- Приглашаем Ваше предприятие к взаимовыгодному сотрудничеству в направлении производства и поставки никелевого сплава [url=https://redmetsplav.ru/store/molibden-i-ego-splavy/molibden-mvch/poroshok-molibdenovyy-mvch/ ] Порошок молибденовый РњРћ [/url] и изделий из него. - Поставка концентратов, и оксидов - Поставка изделий производственно-технического назначения (рифлёнаяпластина). - Любые типоразмеры, изготовление по чертежам и спецификациям заказчика. [url=https://redmetsplav.ru/store/molibden-i-ego-splavy/molibden-mvch/poroshok-molibdenovyy-mvch/ ][img][/img][/url] [url=https://4ar.3dn.ru/news/dobavlen_novyj_forum/2009-12-07-10]сплав[/url] [url=https://reviews.worldplaces.me/read-review/84180-excellent-dog-and-cat-kennels.html]сплав[/url] 2eb4d59

canadian drugs online pharmacy - Jan. 12, 2024, 12:11 p.m.

- Hello it's me, I am also visiting this site daily, this web page is genuinely fastidious and the visitors are genuinely sharing nice thoughts.

arbitrazhn_easl - Jan. 12, 2024, 12:31 p.m.

- Нужен арбитражный юрист? Вы на правильном пути!| Опытная помощь арбитражного юриста в любой ситуации!| Нужен совет арбитражного юриста? Обращайтесь к нам!| Работаем на результат!| Ищете арбитражного юриста, с недорогими тарифами? Мы готовы вам помочь!| Наш опыт и знания позволят найти выход из любой ситуации.| Полное сопровождение дела от арбитражного юриста в компании название компании.| Качественная защита на всех этапах арбитражного процесса.| Обращайтесь к нам и будьте уверены в правильности решения.| Профессиональный подход к каждому делу - это арбитражный юрист название компании.| Мы предоставляем все виды юридической помощи в области арбитражного права. помощь адвоката арбитражный дело [url=https://www.arbitrazhnyj-yurist-msk.ru/]https://www.arbitrazhnyj-yurist-msk.ru/[/url].

order stromectol no prescription - Jan. 12, 2024, 12:41 p.m.

- I could not resist commenting. Exceptionally well written!

prokat888_nlpt - Jan. 12, 2024, 1:06 p.m.

- Без залога - аренда инструмента в Красноярске прокат инструмента в красноярске без залога [url=https://prokat888.ru#прокат-инструмента-в-красноярске-без-залога]https://prokat888.ru[/url].

stromectol headache - Jan. 12, 2024, 4:21 p.m.

- Hello to all, it's actually a fastidious for me to pay a visit this website, it includes valuable Information.

stromectol scabies - Jan. 12, 2024, 11:41 p.m.

- hello there and thank you for your information – I have definitely picked up anything new from right here. I did however expertise a few technical points using this website, as I experienced to reload the website a lot of times previous to I could get it to load properly. I had been wondering if your web hosting is OK? Not that I'm complaining, but sluggish loading instances times will sometimes affect your placement in google and can damage your quality score if ads and marketing with Adwords. Anyway I'm adding this RSS to my e-mail and can look out for a lot more of your respective fascinating content. Ensure that you update this again very soon.

stromectol cvs - Jan. 13, 2024, 3:16 a.m.

- Hello! Someone in my Facebook group shared this website with us so I came to give it a look. I'm definitely loving the information. I'm book-marking and will be tweeting this to my followers! Terrific blog and amazing style and design.

stromectol medication - Jan. 13, 2024, 6:23 a.m.

- It's awesome to go to see this website and reading the views of all colleagues about this article, while I am also keen of getting know-how.

buy stromectol online - Jan. 13, 2024, 9:40 a.m.

- I am in fact delighted to glance at this weblog posts which includes tons of valuable data, thanks for providing these kinds of statistics.

pharmacies shipping to usa - Jan. 13, 2024, 12:03 p.m.

- Hello, its nice paragraph about media print, we all understand media is a fantastic source of data.

best online canadian pharmacy - Jan. 13, 2024, 2:07 p.m.

- I just like the helpful information you provide to your articles. I'll bookmark your weblog and take a look at once more here frequently. I am slightly sure I will be informed a lot of new stuff right here! Best of luck for the following!

what is stromectol used for - Jan. 13, 2024, 4:44 p.m.

- Hello i am kavin, its my first occasion to commenting anywhere, when i read this paragraph i thought i could also create comment due to this good paragraph.

canadian pharmaceuticals - Jan. 13, 2024, 5:35 p.m.

- I am regular reader, how are you everybody? This paragraph posted at this site is really fastidious.

stromectol france - Jan. 13, 2024, 8:18 p.m.

- First of all I would like to say awesome blog! I had a quick question that I'd like to ask if you do not mind. I was curious to find out how you center yourself and clear your head prior to writing. I have had a tough time clearing my mind in getting my ideas out. I truly do take pleasure in writing however it just seems like the first 10 to 15 minutes are usually wasted just trying to figure out how to begin. Any ideas or tips? Thanks!

shoppers pharmacy - Jan. 13, 2024, 9:04 p.m.

- It's awesome in support of me to have a web site, which is useful in support of my experience. thanks admin

EdwinLib - Jan. 13, 2024, 11:19 p.m.

- Откройте для себя подводный мир с нашими <a href="https://idc-padi.ru/">курсами по обучению дайвингу</a>!

buy stromectol scabies online - Jan. 13, 2024, 11:48 p.m.

- Pretty section of content. I just stumbled upon your weblog and in accession capital to assert that I acquire actually enjoyed account your blog posts. Anyway I'll be subscribing to your feeds and even I achievement you access consistently rapidly.

online pharmacies - Jan. 14, 2024, 1:48 a.m.

- What's up everybody, here every person is sharing these kinds of familiarity, thus it's good to read this website, and I used to pay a quick visit this webpage every day.

stromectol medication - Jan. 14, 2024, 6:39 a.m.

- Hi my friend! I want to say that this article is amazing, great written and come with approximately all vital infos. I'd like to look more posts like this .

canadian pharmacy review - Jan. 14, 2024, 8:43 a.m.