Looking to start investing your own money? Sick of the fees your advisors are charging you? With brokerages like Questrade, that’s now easier than ever. Whatever your investment style, Questrade has a solution for you. Named Canada's best online broker in 2021, they offer some of the lowest fees in Canada to go along with many helpful investment tools. In this review we try to be as neutral as possible, looking at the pros and cons of Questrade.

Pros |

Cons |

| - Low Fees on stocks and ETFs | - Market research lacking/not easily available |

| - Easy to use | - Margin rates higher than competition |

| - Research tools available | - Commissions on options can get expensive |

| - Great customer support | |

| - QuestWealth great for hands off investors | |

| Able to hold USD without converting back and forth |

Questrade was founded in 1999 by Edward Kholodenko and his three partners. It currently has over $25 billion in assets under administration, with over 200,000 new accounts opened annually. It is fully regulated and protected just like the big banks by IIROC and has an additional $10 million in private insurance. Questrade was ranked Best Online Broker by MoneySense for 2021.

- Account Types

- QuestWealth Portfolios

- Funding

- Fees

- Trading Platforms

- Practice Accounts

- Market Research/Learning Center

- Data Packages

- Customer Support

- Conclusion

Account Types

All normal investment account types are offered at Questrade, including TFSA, RRSP, RSP, LIRA, RIF, LIF, RESP, Non-Registered, Forex and CFDs, and Margin accounts. There is no minimum in order to open any account, but it must be funded with $1000 to start investing.

One of the biggest benefits of Questrade is the ability to hold USD currency, rather than exchanging it back and forth and being charged currency exchange fees.

QuestWealth Portfolios

QuestWealth Portfolios provide a perfect solution for investors that prefer a more hands off approach. They have 5 different globally diversified ETF portfolios available depending on the level of risk you’re comfortable with, and your time horizon. They also offer 5 similar funds that are Socially Responsible Investing (SRI), which allows you to support companies that focus on social, corporate, and environmental issues. They walk you through the easy set-up, asking you questions about your goals and time horizon, to find the best portfolio for you.

These portfolios have very low fees of 0.20% with over $100,000 invested, or 0.25% if less, plus the MER of the ETF’s (range from 0.1%-0.14%). They have calculators showing you exactly what your fees are depending on your balance, as well as a calculator showing your potential gains over time. The fees on the SRI funds are slightly higher.

These funds are actively managed. Portfolio managers also take advantage of tax-loss harvesting, which lowers capital gains taxes in cash accounts. All dividends are reinvested automatically to take full advantage of compounding.

If you are interested in the QuestWealth portfolios, the banner below will give you your first $10,000 managed free!

Funding

Questrade recently introduced instant deposit, which allows you to fund your account in minutes. You can do this for up to $3500 per day with Interac or a Visa Debit card. This has turned out to be a great addition for me personally, as there were a few times where a great opportunity arose in the market, and I needed more funds as soon as possible. This feature is not available on any other discount brokerage as far as I’m aware.

Most other traditional funding methods are also available, such as wire transfer, online banking bill payment, pre-authorized deposit, ect.

Fees

Questrade is very transparent with their fees and offer some of the lowest rates in Canada for stocks and ETFs. There is no fee to open an account, and no inactivity fees. It is also free to transfer accounts to Questrade. If you want to trade options, Questrade is a bit more expensive than some alternative brokers unless you unlock the active trader pricing.

In terms of commissions, ETF’s are free to purchase, and stocks are $0.01 per share (minimum $4.95, maximum $9.99. Options are $9.95 to buy/sell, plus $1 per contract, and $24.95 for exercise/assignment.

They also offer two plans with special pricing for active traders, but you must purchase advanced market data packages (refundable if you make a certain number of trades per month) to unlock them. Both plans lower the cost of trades and options.

Trading Platforms

Questrade offers a few different platforms for trading to suit the type of investor you are.

Questrade Trading (Web)

The most common platform is Questrade Trading, which is simply their web-based platform. This makes it easy to view all your accounts, make trades, view company statistics in real time, view the latest news articles, look at the latest initial public offerings (IPOs), and do research on companies. This platform has been recently updated, and I have noticed some annoying bugs in the first few weeks it was released, but most of them we’re fixed in a timely manner.

QuestMobile

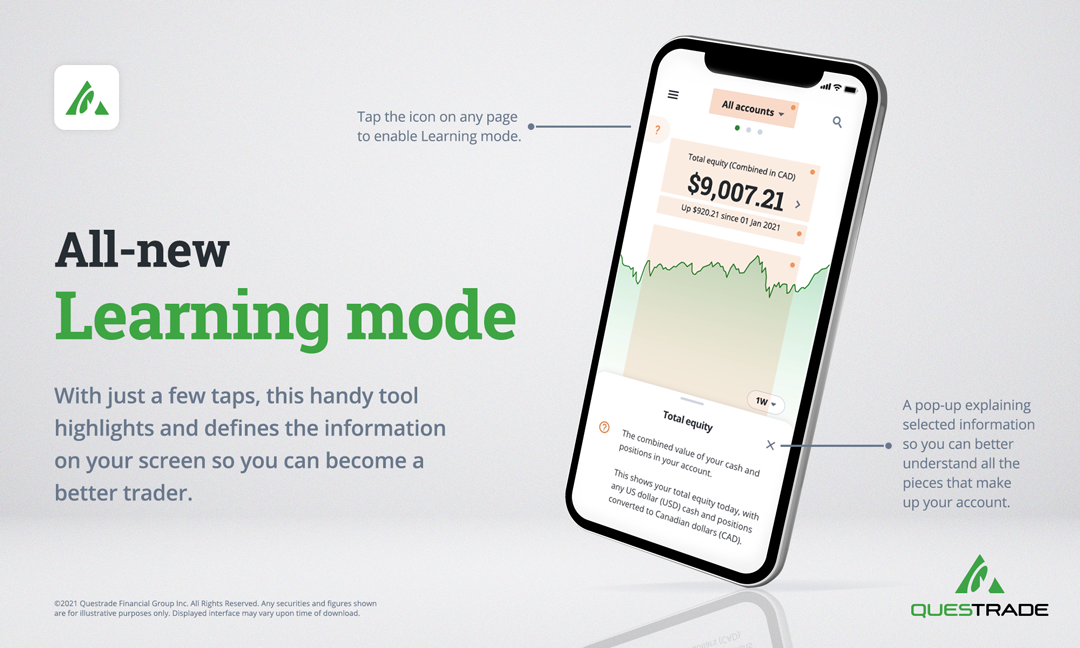

They recently released a new mobile app that is now able to do almost everything that the web platform can do. On the previous app you could not deposit money, which was annoying. The new app has solved that problem and works a lot better. The app allows you to chat with customer support, view your balances/returns, look at your watchlists, view the latest news, and of course make trades. It is very easy to use, and I have been very impressed with it so far.

They have also implemented a new "learning mode" that allows users to learn tips and tricks while navigating the app.

Questrade Edge

Questrade Edge is their advanced trading platform, which is available in web and desktop versions. It offers advanced order types (such as bracket, conditional, and multi-leg options), customizable trading environment, and tons of research tools from TipRanks, Trading Central, and Morning Star.

As a long-term investor, and not much of an active trader, I personally don’t use this platform. For the purposes of this review, I downloaded the desktop version and used it for a few days just so I’m able to give my honest opinion on it. I must say I’m impressed.

You start off by customizing your environment or choosing a default. It offers a stock screener which allows you to filter stocks by tons of technical/fundamental indicators. The charts are highly customizable and make it easy to add moving averages to.

There are a lot of research tools available on the platform, including StockTwits which allows you to easily see the latest tweets about any stocks or news in general. The market movers widget shows you the top gainers, top losers, most active, and more. The trending stocks widget, powered by TipRanks, shows the best/ worst/most rated stocks over a given time frame. You can also filter by market cap and sector. They also have an Intraday Trader app which they describe as “your personal algorithmic technical analysis tool with customizable watch lists, searchable technical patterns, and regular updates on identified patterns throughout the trading day”.

In summary I would highly suggest checking out Questrade Edge, especially if you are an active trader. They offer a practice account for 90 days free. They also have a mobile version of Edge being developed at the moment.

Practice Accounts

Not sure if you’re ready to invest with real money yet? Questrade allows you to open a practice account, risk-free. They give you $500,000 CAD and $500,000 USD virtual cash to try out all features on Questrade. It only takes a few seconds to sign up, then you can log in and start trading. Practice accounts are available for the Questrade Edge and Questrade Trading platforms, as well as Questrade Global for FX and CFD. Unfortunately it is not available on the mobile app.

Market Research/Learning Center

Questrade has a market research center on the website that quite frankly I’d like to see improved. The Edge platform has great tools, including StockTwits, TipRanks, Market Movers, etc. but I’d like to see these tools included on the website as well. They do have an Intraday Research application that is perfect for active traders.

They do have a blog with articles designed to help investors with questions they may have, such as taxes, differences between account types, improving returns, etc. They also have webinars that introduce people to index investing, dividend investing, technical analysis, and ETF investing strategies. If you’re investing for your retirement, they have calculators to help you plan better. If you have any questions about anything, you can also contact support.

Data Packages

Questrade offers 1 free and 3 paid market data packages. You can get up to 100% of the cost refunded if you spend a certain amount in commissions. The two advanced data packages unlock active trading pricing, which lowers commissions on fixed/variable plans.

On the fixed plan it lowers the commission on stocks to $4.95/trade, options to $4.95 + $0.75/contract, ETF’s free to buy and $4.95 to sell, and pips as low as 0.8. On the variable plan it changes commissions to $0.01/share up to a maximum of $6.95 (minimum $0.01), options to $6.95 + $0.75/contract, ETF’s free to buy and sell for $0.01/share to a maximum of $6.95.

- Basic – Free

- - Free level 1 snap quotes for the largest Canadian and US markets

- One-click real-time data

- Comes with every platform - Enhanced - $19.95/month (Spend more than $48.95 in trading commissions for full refund)

- - Free level 1 snap quotes

- Enhanced level 1 live streaming data

- Live streaming for Intraday Trader

- Individual data add-ons available - Advanced U.S. Data - $89.95 USD/month (spend $48.95 for partial refund, or $399.95 for full refund)

- - Unlocks active trader pricing

- Advanced level 1 and level 2 U.S. live streaming data

- Select level 1 Canadian live streaming data

- Individual data add-ons available - Advanced Canadian Data -$89.95/month (spend $48.95 for partial refund, or $399.95 for full refund)

- - Unlocks active trader pricing

- Advanced level 1 and level 2 Canadian live streaming data

- Select level 1 U.S. live streaming data

- Individual data add-ons available

Customer Support

If I was writing this blog post a year ago, I would have given them 2 stars out of 5 for customer support. Even though everyone I talked to was very helpful, it would sometimes take an hour to get through to someone. They have since hired a lot more support staff, and I can now get through within a minute or two. Generally, the support staff are very knowledgeable, and when they don’t know something, they will go ask someone else and get back to you within a few minutes.

Support is available Monday to Friday via live chat, phone, or email. Having the live chat is very convenient.

Conclusion

Questrade is a great discount brokerage that I have personally used for over 10 years. Over the years they have had their issues such as long wait times for support and bugs during updates, which they have fixed in a timely manner. They provide many tools to make trading easy, no matter if you’re interested in self-directed accounts or managed accounts. For people that prefer to be more hands off with their investments, QuestWealth provides a great way to still get a good return with low fees. If you’re more of a hands-on investor, Questrade has a lot of great tools to help you in your investment journey, and their low fee structure allows you to keep as much of your returns as possible.

If you are looking for a new brokerage, we highly recommend you give Questrade a try.

Disclaimer: I only recommend products I would use myself. This blog post contains affiliate links that may give me a commission if users sign up. We have attempted to give our honest opinion throughout the blog post.

0 comments

There are no comments yet.